Medicare and Medicaid Benefits: Navigating Healthcare Coverage for Seniors

all pannel.com, new betting id, gold365: Navigating healthcare coverage for seniors can often feel overwhelming, especially when it comes to understanding the benefits provided by Medicare and Medicaid. These two government-sponsored programs offer essential support for older adults in the United States, but the details of what is covered and how to access these benefits can be complex. In this blog post, we will break down the key aspects of Medicare and Medicaid, helping you make informed decisions about your healthcare coverage.

Understanding Medicare

Medicare is a federal health insurance program primarily designed for people aged 65 and older, as well as certain younger individuals with disabilities. There are four parts to Medicare, each covering different aspects of healthcare:

Part A: Hospital Insurance

Part B: Medical Insurance

Part C: Medicare Advantage

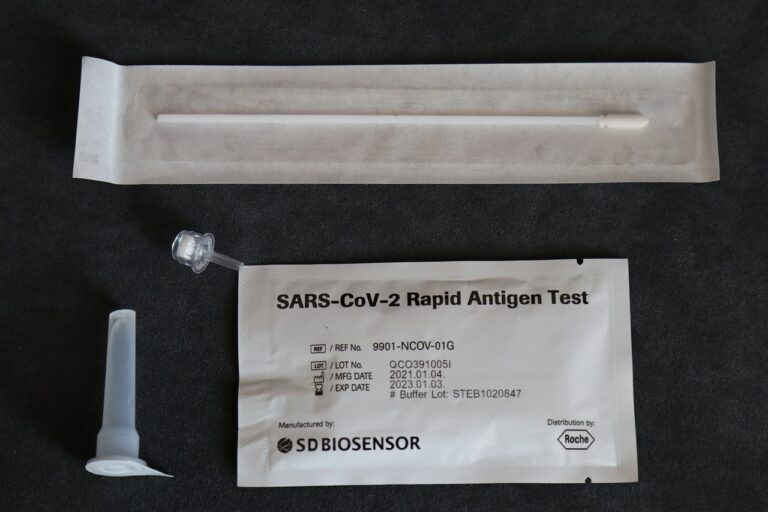

Part D: Prescription Drug Coverage

These different parts provide coverage for hospital stays, doctor visits, prescription medications, and more. It’s important to understand what each part covers and how they work together to provide comprehensive healthcare coverage.

Choosing the Right Medicare Plan

When you first become eligible for Medicare, you have the option to enroll in Original Medicare (Parts A and B) or a Medicare Advantage plan (Part C) offered by a private insurer. Each option has its pros and cons, so it’s essential to carefully consider your healthcare needs and budget when making this decision.

If you choose Original Medicare, you may also want to purchase a standalone prescription drug plan (Part D) to ensure coverage for your medications. Additionally, you may want to consider purchasing a Medicare Supplement (Medigap) policy to help cover out-of-pocket costs not covered by Original Medicare.

Medicaid Benefits for Seniors

Medicaid is a joint federal and state program that provides health coverage to low-income individuals, including seniors who may not qualify for Medicare. While Medicaid is primarily aimed at individuals with limited financial resources, eligibility requirements vary by state, so it’s essential to check with your state’s Medicaid office to determine if you qualify.

Medicaid benefits can vary widely depending on where you live, but they typically cover a broad range of services, including doctor visits, hospital stays, prescription drugs, and long-term care. Seniors who are eligible for both Medicare and Medicaid (dual-eligibles) can access an even wider range of benefits to help meet their healthcare needs.

FAQs About Medicare and Medicaid

Q: Can I have both Medicare and Medicaid?

A: Yes, many seniors are eligible for both Medicare and Medicaid, known as dual-eligibles. This arrangement can provide comprehensive coverage for a wide range of healthcare services.

Q: How do I apply for Medicaid?

A: To apply for Medicaid, you will need to contact your state’s Medicaid office or visit the Medicaid website for your state. Eligibility requirements vary by state, so it’s essential to check with your state’s Medicaid office for specific details.

Q: Do I need to enroll in Medicare if I have Medicaid?

A: If you are eligible for both Medicare and Medicaid, it’s typically recommended that you enroll in both programs to access the full range of benefits available to you. Speak to a healthcare provider or Medicaid representative for guidance on enrolling in both programs.

Q: What services are covered by Medicaid for seniors?

A: Medicaid benefits for seniors can vary by state, but they typically cover a wide range of services, including doctor visits, hospital stays, prescription medications, and long-term care. Check with your state’s Medicaid office for specific details on covered services.

Navigating healthcare coverage can be challenging, but understanding the benefits provided by Medicare and Medicaid can help you make informed decisions about your healthcare needs as a senior. By familiarizing yourself with the details of each program and seeking guidance from healthcare providers and state agencies, you can ensure you have the coverage you need to stay healthy and well.